Taxation

Taxation

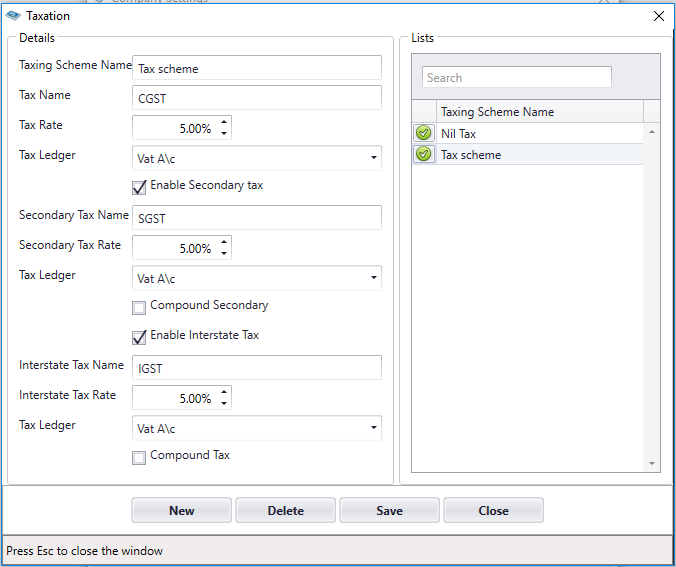

InventoryPlus support managing the multiple type of taxes. Created tax can be mapped to each items. Configure the Taxation, goto Settings -> Company details -> "General settings" section (or Products Details window) and click on Taxation button to open the the screen.

Configuring GST taxation:

Creation of primary tax scheme

- Enter all different types of tax slab should be entered in this screen

- Enter the valid Description as it is displayed in Product's price scheme

- Percentage will be used for calculating the item tax.

- Select the tax ledger created in accounting module.

Creation of secondary tax scheme

- Select the Enable Secondary tax to enable the secondary tax calculation

- If you want to calculate the compound tax then select "Compound Secondary" checkbox (Ex. secondary tax will be calculated on Total Amount + Primary tax)

- Percentage will be used for calculating the item tax.

- Select the tax ledger created in accounting module.

Creation of Interstate Tax scheme

- Select the Enable Interstate tax to enable the Interstate tax calculation

- If you want to calculate compound tax then select "Compound tax" checkbox (Ex. Interstate tax will be calculated on Total Amount + Primary tax)

- Percentage will be used for calculating the item tax.

- Select the tax ledger created in accounting module.

Refer the You tube Video

Configuring VAT taxation:

- Enter Tax Name as VAT (purchase and tax report screen will display the VAT % instead of CGST in grid header only if you enter VAT in this field)

- Secondary, Interstate and CESS selection is not required for VAT taxation.

Refer the Youtube Video https://youtu.be/32IyuVaSWik

Note:

- Updated tax will be available in Product screen. Go to Product screen to select tax for each items.

- GST tax format should be updated as Primary tax=CGST, Secondary =SGST, Interstate = IGST. Refer above screen shot or Video for more details.

- When you enter Tax Name as VAT then system will auto calculate the VAT%

- IGST Tax scheme will be considered for calculation only when Interstate Party check box is selected in Customer/Vendor screen.